Serious About Sustainability

WATCH VIDEO

WATCH VIDEO

We Recycle More than we Use

We create packaging solutions for life's essentials.

2030 SUSTAINABILITY TARGETS

These targets set specific and measurable goals that build on the company’s announcement in 2021 to reduce absolute Scope 1 and 2 greenhouse gas (GHG) emissions 28% by the end of the decade.

The broader sustainability focus for the company continues to be advancing a circular economy, reducing greenhouse gas emissions, and championing diversity, equity & inclusion initiatives.

97%

Reach Zero Waste to Landfill at 97% of its Production Facilities

By reducing, recycling, composting, reusing, and incinerating with energy recovery, Greif targets 97% of its production facilities achieving zero-waste to landfills by 2030.

100%

Make 100% of its Products Recyclable

Working across a vast portfolio of raw materials and products, Greif recyclability targets will be benchmarked by weight, and consolidated at a company level.

60%

Achieve an Average of 60% Recycled Raw Material Content Across Products

Recycled content targets for Greif products are minimum averages benchmarked across a portfolio of materials and products by weight, consolidated at a company level.

=

Attain Global Gender Pay Parity

Greif is on track to ensure colleagues receive equal pay for equal work by 2024 and is committed to maintaining gender pay parity.

80%

Evaluate the Sustainability Performance for 80% of Total Spend with Suppliers

By aiming to increase the evaluation of the sustainability performance of its suppliers, Greif can have a greater impact across its value chain.

GREIF LAUNCHES 2023 SUSTAINABILITY REPORT

Greif’s 2023 Sustainability Report covers our fiscal year from November 1, 2022, through October 31, 2023. This report is prepared in accordance with the GRI Standards and SASB Application Guidance and fulfills the United Nations Global Compact’s (UNGC) annual Communication on Progress (COP).

Sustainability in Action

Recycling

Greif paper packaging is a net-positive recycler. Creating materials from scratch has a significant impact on the environment. Contact us about our recycling services, including collecting paper, paperboard, and plastics, to developing custom solutions.

Green Tool

Calculate your carbon footprint with Greif. Both easy and cost-effective, the Greif Green Tool provides insight into the environmental impact of packaging used for fillers and emptiers. It makes local reporting seamless and empowers smart sustainability choices.

- News & Blogs

- Events

Latest News & Blogs

Greif Completes Acquisition of Ipackchem

Greif Prepares For Opening of a New Manufacturing Facility in Texas

Greif Expands Global Presence with New IBC Manufacturing Facility in Malaysia

Events

ProPak Cape 2023

Tradeshow

October 24–26, 2023

Johannesberg, South Africa

Hall Number: 3 Stand Number: B73

ProPak Cape 2023

Tradeshow

September 4 -8, 2023

Booth B6: Greif Chile S.P.A

Apimondia 48th International Apicultural Congress 2023 Chile

Greif will be at booth B06

Tradeshow

OCTOBER 24–26, 2023

Auditorium Building, Gate 2, Expo Centre, Cnr Rand Show & Nasrec Roads, Johannesburg, 2013

ProPak Cape 2023

Trade Show

May 4-10, 2023

Dusseldorf, Germany

Interpack 2023

Greif will be at booth B07/B17

Tradeshow

OCTOBER 25 – 27, 2022

Hyatt Regency Orange County, Garden Grove, CA

Sample Heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis.

Tradeshow

JUNE 28 – 30, 2022

Charleston, South Carolina

Specialty & Agro Chemicals America

Visit us at Booth # 507

Trade Show

May 4-10, 2023

Dusseldorf, Germany

Interpack 2023

Greif will be at booth B07/B17

Tradeshow

OCTOBER 25 – 27, 2022

Hyatt Regency Orange County, Garden Grove, CA

Sample Heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis.

Check back later for upcoming events and subscribe to our newsletter to stay up to date on Greif.

Latest Events

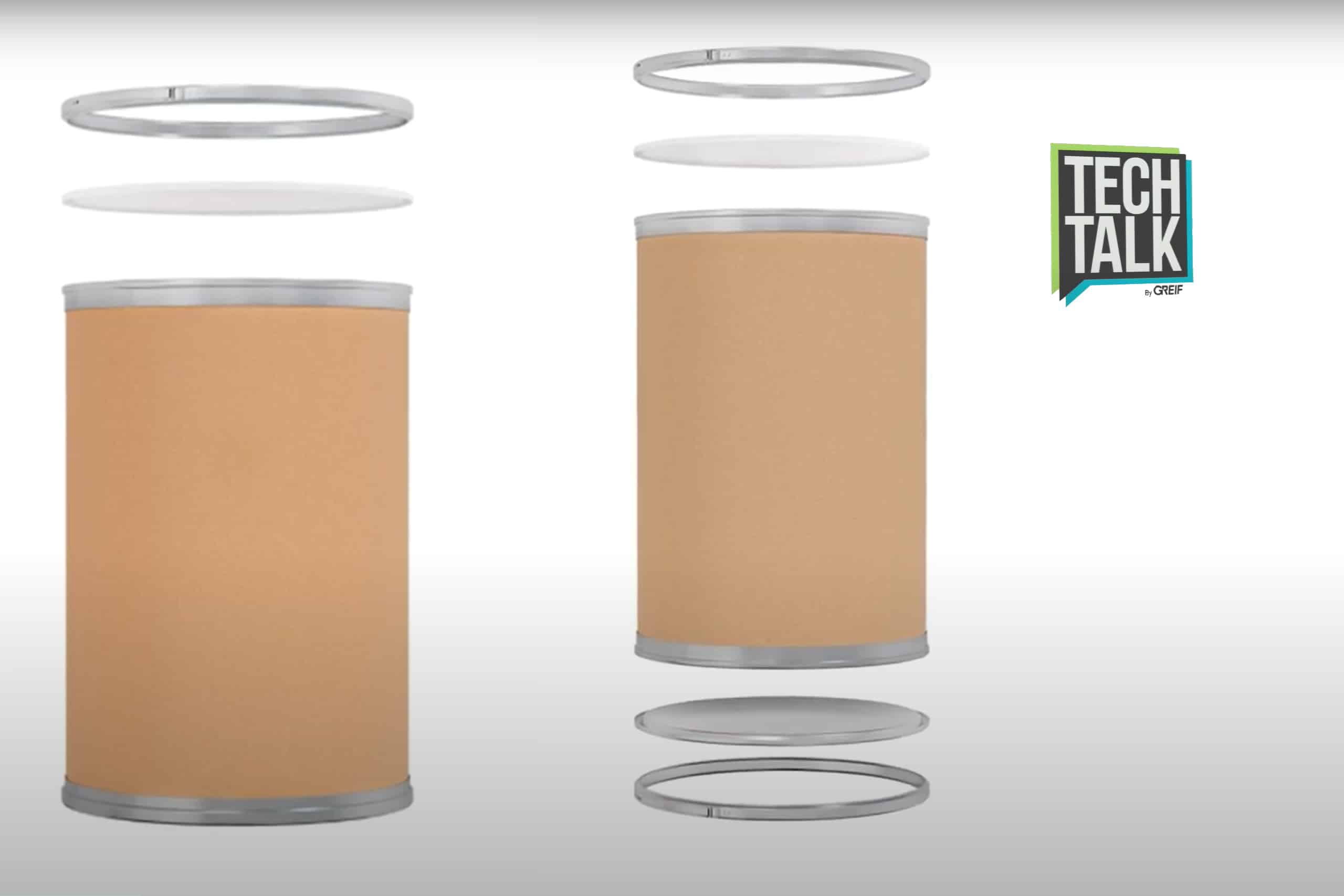

All-Fi and Ro-Con Tech

Liquipak Fibre Drum Tech

Hot-Flo & Cold-Flo Tech

Career Spotlight

Work with a Purpose

We create packaging solutions for life’s essentials. The delicious, necessary, or fun products end-users delight in or rely on come to the global market in our packaging. We make a difference in getting them to their intended use as the global community needs them to be.

Career Spotlight

Work with a Purpose

Packaging Success Together perfectly describes how we serve customers, who we are, and where we want to go – together

Giving Back and Building a Better Tomorrow

Greif is committed to building a better tomorrow by giving back to our communities today. At Greif, we aim to create thriving communities where we live and work. Following The Greif Way, we strive to create a culture that supports the common good by using our financial and human resources to support charitable organizations focusing on education, health, and social services.

Markets We Serve

Greif is proud to serve a wide range of global industries’ unique needs, from the products that keep the world moving to those that add beauty.

Retail Packaging

Greif’s network of dedicated sheet feeders manufacture corrugated sheets, from single to triple wall board constructions, with an array of flutes, paper grades, coatings, and testing services.

Commodity Chemicals

Packaging must protect product purity, comply with regulations, and support safety. We have the right technology, capabilities, and people to meet all specialty chemical industry requirements.

Health & Beauty

We are a reliable partner to those who supply the wellness, fragrance, food and beverage, and home and personal care markets with the materials to enhance their products.

Paints, Coatings & Ink

Greif offers large, intermediate, and specialty fibre, plastic or steel drums, and IBCs that offer a truly customized solution with the appropriate components for the paint, coating, or ink market.

Industrial Goods

Greif gets it – you need packaging that meets stringent technical and regulatory requirements. Learn more about how we deliver for our customers in the industrial and consumer goods industry.

Lubricants & Petrochemicals

Greif has the right technology, capabilities, and people to meet all of appropriate technical and regulatory requirements of the lubricant industry.

Mining & Construction

Our EasyPourTM concrete forming tubes are one of the leading brands in the industry. Additionally, we make blast tubes for dry and wet mining.

Agriculture

At Greif, we have decades of experience designing and producing packaging that protects food from contamination sources and is compliant with strict food safety regulations.

Distributors

Greif’s network of sheet feeders and industrial packaging plants provides corrugated sheets, bulk boxes, corner protectors and pallet cover for your distribution needs.

Specialty Chemicals

Greif understands your requirements and can offer solutions that minimize risk of contamination during storage and transportation of your product in our packaging solutions.

Waste & Nuclear

Safe and reliable solutions are crucial for the waste and nuclear energy industry. Greif offers steel drums with appropriate components that meet regulatory and safety requirements.

Food & Beverages

At Greif we have decades of experience designing and producing packaging that protects food from contamination sources and is compliant with strict food safety regulations.

Flavors & Fragrances

With Greif’s complete range of industrial packaging for Flavors & Fragrances, you not only find solutions that meet your requirements, but also maintain your high-quality standards.